How to Read a Stock Quote: A Beginner’s Guide (2025)

Understanding stock quotes is crucial for making informed investment decisions; this guide breaks down the key elements of a stock quote, including price, volume, and other essential market data, providing beginners with the knowledge to navigate the stock market effectively in 2025.

Want to understand what all those numbers and abbreviations mean when you look at a stock quote? This beginner’s guide will teach you how to read a stock quote: a beginner’s guide to understanding market data in 2025, so you can make informed investment decisions.

Understanding the Basics of a Stock Quote

Stock quotes are snapshots of a stock’s performance at a specific point in time. They provide essential information that can help investors make informed decisions about buying or selling stocks, and will help you with How to Read a Stock Quote: A Beginner’s Guide to Understanding Market Data in 2025. Let’s start by exploring the key components of a typical stock quote.

What is a Stock Symbol (Ticker)?

A stock symbol, also known as a ticker symbol, is a unique abbreviation used to identify a publicly traded company on a stock exchange. For instance, Apple Inc. is represented by the symbol AAPL.

The Significance of the Last Trade Price

The last trade price indicates the most recent price at which a stock was traded. It’s a crucial piece of information because it reflects the current market value of a single share.

Here are essential components often found in a stock quote:

- Open: The price at which the stock first traded during the current trading day.

- High: The highest price reached by the stock during the current trading day.

- Low: The lowest price reached by the stock during the current trading day.

- Close: The final price at which the stock traded when the market closed on the previous trading day.

Understanding these basics is the first step to mastering how to read a stock quote. Knowing what each element represents allows you to assess a stock’s performance and potential.

Deciphering Key Metrics in a Stock Quote

Beyond the basic elements, several key metrics offer deeper insights into a stock’s activity. Understanding these metrics can help you gauge market sentiment and make more informed investment decisions, ensuring you know How to Read a Stock Quote: A Beginner’s Guide to Understanding Market Data in 2025. Let’s delve into some essential metrics.

Volume: Measuring Trading Activity

Volume represents the number of shares traded during a specific period, usually a trading day. High volume can indicate strong interest in the stock, while low volume may suggest a lack of investor attention.

Bid and Ask Prices: Understanding Supply and Demand

The bid price is the highest price a buyer is willing to pay for a stock, while the ask price is the lowest price a seller is willing to accept. The difference between these two is known as the bid-ask spread. This spread is often used to help determine the liquidity of the stock.

Essential metrics for analysis includes:

- 52-Week High: The highest price the stock has traded at over the past 52 weeks.

- 52-Week Low: The lowest price the stock has traded at over the past 52 weeks.

- Earnings per Share (EPS): A company’s profit allocated to each outstanding share of common stock.

- Price-to-Earnings Ratio (P/E Ratio): The ratio of a company’s stock price to its earnings per share, used for valuing the company.

By deciphering these key metrics, investors can gain a more comprehensive understanding of a stock’s performance and potential. Each metric provides unique insights, enabling better-informed decisions in the market.

Using Online Tools and Platforms for Stock Quotes

Numerous user-friendly online tools and platforms are available to access real-time stock quotes and market data. These platforms provide comprehensive information, including charting tools, news feeds, and analysis, aiding investors in How to Read a Stock Quote: A Beginner’s Guide to Understanding Market Data in 2025. Let’s explore some popular options.

Popular Websites for Stock Quotes

Many websites offer free stock quotes and market data. These sites often include interactive charts and news articles that can help you stay informed.

Mobile Apps for On-the-Go Access

Mobile apps allow investors to access stock quotes and manage their portfolios from anywhere. These apps often offer customizable alerts and real-time data updates so you can stay on top of the market.

Some reliable sources include:

- Google Finance: A free and comprehensive tool for tracking stocks and market trends.

- Yahoo Finance: Offers real-time quotes, news, and portfolio tracking.

- Bloomberg: Provides professional-grade financial data and analysis.

- Brokerage Platforms: Many online brokers offer built-in tools for accessing stock quotes and conducting research.

Online tools and platforms are invaluable resources for accessing real-time stock quotes and market data. They empower investors to stay informed and make timely decisions, enhancing their overall investment strategy.

Understanding Market Indicators and Indices in 2025

Market indicators and indices are benchmarks that provide an overview of the overall market or specific sectors. Monitoring these indicators can help investors understand market trends and make informed decisions, contributing to their knowledge of How to Read a Stock Quote: A Beginner’s Guide to Understanding Market Data in 2025. Let’s examine some key indicators.

The Role of the S&P 500

The S&P 500 is a stock market index that represents the performance of 500 of the largest publicly traded companies in the United States. It is widely regarded as a benchmark for the overall U.S. stock market.

The Importance of the Dow Jones Industrial Average (DJIA)

The DJIA is a price-weighted index that tracks 30 large, publicly owned companies trading on the New York Stock Exchange (NYSE) and the Nasdaq. It offers a snapshot of the performance of major U.S. corporations.

Key indicators include:

- NASDAQ Composite: An index that tracks all the stocks listed on the NASDAQ stock exchange.

- Russell 2000: An index that represents the performance of 2,000 small-cap companies in the U.S.

- VIX (Volatility Index): A real-time market index representing the market’s expectations for volatility over the coming 30 days.

Understanding market indicators and indices provides investors with a broader perspective on market trends and economic conditions. These benchmarks offer valuable insights for strategic decision-making.

Analyzing Historical Data for Stock Quote Insights

Historical data is crucial for identifying patterns and trends in a stock’s performance. Analyzing past performance can provide insights into volatility, growth potential, and overall investment risk, enhancing your understanding of How to Read a Stock Quote: A Beginner’s Guide to Understanding Market Data in 2025. Let’s explore how to leverage historical data.

Identifying Trends and Patterns

Examining historical stock quotes can reveal trends such as upward or downward movements over time. These patterns can help investors predict future performance and make informed decisions.

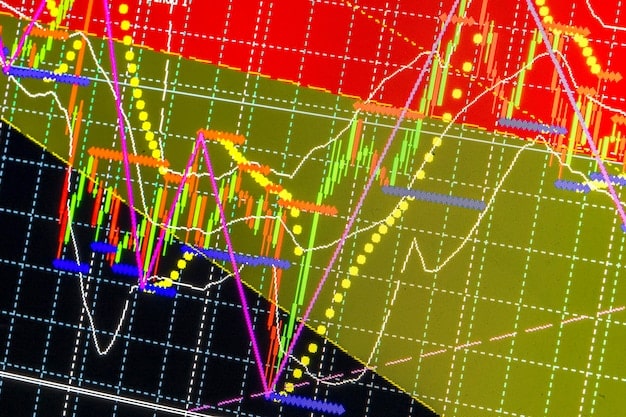

Using Charts and Graphs for Visual Analysis

Charts and graphs offer a visual representation of historical data, making it easier to identify trends and patterns. Tools like line charts, bar graphs, and candlestick charts are commonly used for this purpose.

Tools and methods to analyze include:

- Moving Averages: Used to smooth out price data by creating an average price that is constantly updated.

- Relative Strength Index (RSI): A momentum indicator used to identify overbought or oversold conditions in a stock.

- MACD (Moving Average Convergence Divergence): A trend-following momentum indicator that shows the relationship between two moving averages of a stock’s price.

Analyzing historical data is essential for gaining deeper insights into a stock’s performance and potential risks. By identifying trends and using visual analysis tools, investors can make better-informed decisions.

Advanced Strategies for Interpreting Stock Quotes in 2025

As you become more experienced, you can use advanced strategies to interpret stock quotes and market data. These strategies often involve combining multiple indicators and considering broader economic factors to make more sophisticated investment decisions, improving your abilities with How to Read a Stock Quote: A Beginner’s Guide to Understanding Market Data in 2025. Let’s explore some of these advanced approaches.

Combining Technical and Fundamental Analysis

Technical analysis involves studying historical data and charts to identify patterns, while fundamental analysis involves evaluating a company’s financial statements and economic factors. Combining these approaches can provide a more comprehensive view of a stock’s potential.

Considering Economic Indicators and News Events

Economic indicators such as GDP growth, inflation rates, and unemployment figures can influence stock prices. Similarly, news events such as earnings reports, product launches, and regulatory changes can have a significant impact.

Advanced considerations:

- Options Trading: Using stock quotes to inform options trading strategies, such as calls and puts.

- Day Trading: Making rapid trades based on intraday stock quote fluctuations.

- Swing Trading: Holding stocks for several days or weeks to profit from short-term price swings.

Advanced strategies for interpreting stock quotes involve a deeper understanding of market dynamics and the ability to combine various analytical techniques. These approaches can help experienced investors make more informed and profitable decisions.

Investing in the stock market can seem daunting at first, especially when trying to decipher all the data presented in a stock quote. However, with a clear understanding of the key components and where to find reliable information, anyone can begin to navigate the market with confidence.

| Key Aspect | Brief Description |

|---|---|

| 🏷️ Ticker Symbol | Unique identifier for a publicly traded company. |

| 💰 Last Trade Price | Most recent price at which a stock was traded. |

| 📈 Volume | Number of shares traded during a trading day. |

| 📊 Market Indices | Benchmarks that provide an overview of the overall market or specific sectors. |

FAQ

▼

The most important thing to look for is the last trade price, as it reflects the current market value of a single share. Observing the volume traded along with this can give you quick, valuable insight.

▼

You can find reliable stock quotes on financial websites like Yahoo Finance and Google Finance, or through your brokerage platform. These sources provide real-time data.

▼

The bid-ask spread is the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask). A narrow spread indicates high liquidity.

▼

Historical data can help you identify trends and patterns in a stock’s performance. Analyzing past performance can provide insights into volatility, growth potential, and overall investment risk.

▼

Market indices like the S&P 500 and DJIA are benchmarks that provide an overview of the overall market or specific sectors. Monitoring these indices can help you understand market trends.

Conclusion

Reading a stock quote is a fundamental skill for anyone involved in the stock market. By understanding the key elements and utilizing the right tools, you can make more informed decisions and navigate the complexities of the market with greater confidence.