Investing in Small-Cap Stocks: Your 2025 Guide to Growth

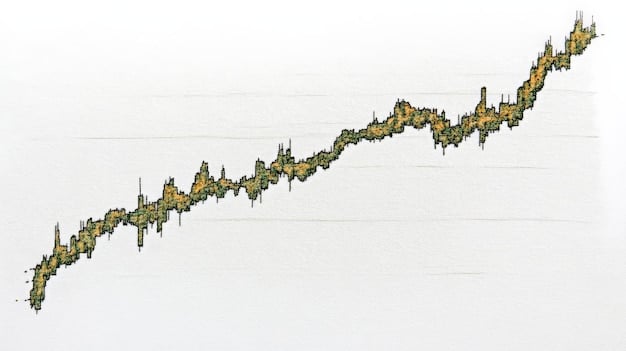

Investing in small-cap stocks for 2025 presents significant opportunities for high growth, but requires careful research, understanding market dynamics, and assessing potential risks and rewards to maximize investment outcomes.

Ready to explore the world of high-growth potential? Investing in small-cap stocks: A guide to high-growth potential in 2025 is your roadmap to navigating this exciting investment landscape, offering insights and strategies to capitalize on emerging opportunities, while understanding the unique challenges and rewards it presents.

Understanding Small-Cap Stocks

Small-cap stocks represent companies with a relatively small market capitalization. These companies often possess the potential for rapid growth, but also come with higher risks compared to larger, more established corporations.

Understanding the dynamics of small-cap stocks is crucial for any investor looking to diversify their portfolio. Let’s delve into what makes these stocks unique and how they differ from their larger counterparts.

What Defines a Small-Cap Stock?

A small-cap stock typically refers to companies with a market capitalization ranging from approximately $300 million to $2 billion. This definition can vary slightly depending on the source or investment firm.

Key Characteristics of Small-Cap Companies

Small-cap companies often share common characteristics, such as a focus on innovation, a strong regional presence, or a niche market focus. These traits can contribute to their growth potential.

These stocks can present significant opportunities:

- Higher Growth Potential: Small-cap stocks have the potential to deliver substantial returns as these companies expand and mature.

- Innovation and Disruption: Many small-cap firms are at the forefront of innovation, disrupting traditional industries with new technologies.

- Undervalued Opportunities: Small-cap stocks may be overlooked by larger institutional investors, creating chances to find undervalued companies.

Understanding these traits and potentials is the first step in investing in small-cap stocks. It’s essential to research and analyze each company individually to make informed decisions.

Why Consider Small-Cap Stocks in 2025?

Investing in small-cap stocks in 2025 could be a strategic move for investors seeking high-growth opportunities. Several factors, including economic forecasts and market trends, suggest a favorable environment for these stocks.

Let’s explore the reasons why small-cap stocks might be an attractive investment option in the coming year.

Economic Factors Favoring Small-Caps

Economic recovery, low interest rates, and increased consumer spending can positively impact small-cap companies, driving their growth and stock performance.

Market Trends and Emerging Industries

Keep an eye on sectors like technology, healthcare, and renewable energy, where small-cap firms are making significant strides, offering unique investment prospects.

Consider the following points of trends to keep in mind:

- Technological Advancements: Companies involved in AI, cloud computing, and cybersecurity are poised for growth.

- Healthcare Innovations: Small-cap biotech and medical device companies may offer significant returns with successful product development.

- Sustainable Energy Solutions: Firms focusing on renewable energy, energy storage, and green technologies align with growing global demand.

The appeal of investing in small-cap stocks lies in their potential to outperform larger companies during periods of economic expansion and technological advancement. However, remember that thorough analysis and risk management are essential.

Identifying Promising Small-Cap Stocks

Identifying promising small-cap stocks requires a rigorous approach. Investors should focus on fundamental analysis, assessing a company’s financial health, growth prospects, and competitive positioning.

Effective strategies are essential for uncovering hidden gems in the small-cap market. Here are some key steps:

Fundamental Analysis: Key Metrics to Consider

Evaluate financial statements, revenue growth, profitability, and debt levels to determine a company’s intrinsic value and potential for future success.

Assessing Growth Potential and Competitive Advantage

Look for companies with strong market positioning, innovative products or services, and the ability to scale their operations efficiently.

To further your understanding, consider these factors:

- Management Quality: Assess the experience, track record, and vision of the company’s leadership.

- Industry Trends: Understand the dynamics of the industry in which the company operates and its potential for growth.

- Competitive Landscape: Evaluate the company’s competitive position and its ability to maintain or improve its market share.

Careful analysis and due diligence are critical when investing in small-cap stocks. By focusing on strong fundamentals, growth potential, and competitive advantages, you can improve your chances of selecting winners.

Risks and Challenges of Small-Cap Investing

Investing in small-cap stocks comes with its own set of risks and challenges. Investors need to be aware of the potential downsides, including volatility, liquidity issues, and information scarcity.

Understanding these risks is crucial for making informed investment decisions. Let’s explore the key challenges in more detail:

Volatility and Market Fluctuations

Small-cap stocks tend to be more volatile than large-cap stocks, experiencing larger price swings in response to market news and economic events.

Liquidity and Trading Considerations

Lower trading volumes can make it difficult to buy or sell small-cap stocks quickly without affecting the price, especially during market downturns.

Here are some factors to mitigate the risks:

- Diversification: Spreading investments across multiple small-cap stocks to reduce the impact of any single investment.

- Long-Term Perspective: Adopting a long-term investment horizon to ride out short-term market fluctuations.

- Due Diligence: Thorough research and analysis to understand the risks associated with each investment.

While the potential rewards of investing in small-cap stocks are significant, it’s important to acknowledge and manage the associated risks. A well-informed and disciplined approach can help navigate these challenges successfully.

Strategies for Successful Small-Cap Investing

Successful small-cap investing requires a well-thought-out strategy. This includes setting clear investment goals, diversifying your portfolio, and staying informed about market developments.

Let’s discuss some key strategies that can help you succeed in the small-cap market:

Setting Clear Investment Goals and Risk Tolerance

Determine your investment objectives, time horizon, and risk appetite before investing in small-cap stocks to ensure alignment with your overall financial plan.

Diversification and Portfolio Allocation

Allocate a portion of your portfolio to small-cap stocks based on your risk tolerance and diversify across different sectors and industries.

Consider these factors when creating your strategy:

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals to reduce the impact of market volatility.

- Regular Portfolio Review: Periodically reviewing your small-cap investments to ensure they still align with your goals and risk tolerance.

- Staying Informed: Keeping up-to-date with company news, financial reports, and industry trends.

A strategic approach is essential for investing in small-cap stocks. By setting clear goals, diversifying your portfolio, and staying informed, you can increase your chances of achieving long-term success.

Tools and Resources for Small-Cap Research

Thorough research is essential for successful small-cap investing. Utilize financial websites, stock screeners, and analyst reports to gather information and make informed decisions.

Let’s explore some valuable resources that can aid your research process:

Financial Websites and Stock Screeners

Use websites like Yahoo Finance, Bloomberg, and Finviz to access company data, news, and stock screening tools that filter stocks based on specific criteria.

Analyst Reports and Investment Newsletters

Subscribe to reputable investment newsletters and access analyst reports from brokerage firms to gain insights into specific small-cap companies and market trends.

- Company SEC Filings: Review 10-K and 10-Q filings to understand the company’s financial performance and risks.

- Industry Reports: Stay informed about industry trends and competitive dynamics through market research reports.

- Financial Ratios: Analyze key financial ratios such as price-to-earnings (P/E), price-to-sales (P/S), and debt-to-equity (D/E) to assess valuation and financial health.

By leveraging these tools and resources, you can enhance your understanding and improve your decision-making when investing in small-cap stocks. Comprehensive research is the cornerstone of successful investing.

| Key Point | Brief Description |

|---|---|

| 🚀 High Growth Potential | Small-caps can deliver substantial returns as they expand and mature. |

| 🔬 Innovative Sectors | Technology, healthcare, and renewable energy sectors offer unique opportunities. |

| ⚠️ Risks & Challenges | Be aware of volatility, liquidity issues, and information scarcity. |

| 📊 Due Diligence | Thorough research is essential for making informed investment decisions. |

Frequently Asked Questions (FAQ)

▼

Small-cap stocks represent companies with a market capitalization typically ranging from $300 million to $2 billion. These firms are often smaller and less established than larger corporations.

▼

Small-cap stocks can offer high-growth potential, driven by economic recovery, emerging industries, and technological advancements. They may also be undervalued compared to larger companies.

▼

Key risks include higher volatility, lower liquidity, and limited information availability compared to large-cap stocks. Market fluctuations can significantly impact small-cap investments.

▼

Focus on fundamental analysis, evaluating financial statements, growth potential, and competitive advantages. Look for companies with strong management and innovative products or services.

▼

Utilize financial websites, stock screeners, analyst reports, and company SEC filings to gather information. Investment newsletters and industry reports can also provide valuable insights.

Conclusion

Investing in small-cap stocks for 2025 presents both opportunities and challenges. By understanding the dynamics of these stocks, implementing effective strategies, and managing risks, investors can position themselves for potential high growth and long-term success in the market..