Dollar-Cost Averaging: Reduce Investment Risk in 2025

Dollar-cost averaging is an investment strategy involving buying a fixed dollar amount of an asset at regular intervals, regardless of its price, which can potentially reduce investment risk by averaging out the purchase price over time, especially beneficial in volatile markets like those expected in 2025.

Are you looking for a strategy to navigate the investment landscape in 2025 with less risk? Dollar-cost averaging might be the answer. Discover how this method can help you smooth out market volatility and potentially improve your investment outcomes.

Understanding Dollar-Cost Averaging

Dollar-cost averaging (DCA) is a long-term investment strategy aimed at reducing the impact of volatility on large purchases of financial assets such as equities. It involves dividing the total sum to be invested across regular purchases of a target asset over a set period of time, instead of investing the entire sum at once.

The Basic Principle

The core idea behind DCA is to mitigate the risk of investing a lump sum at a market peak. By investing a fixed amount regularly, an investor buys more shares when prices are low and fewer shares when prices are high. Over time, this can lead to a lower average cost per share compared to buying all shares at once.

Why Consider DCA?

Especially in a volatile market like the one anticipated in 2025, DCA helps to smooth out the price fluctuations. It’s a disciplined approach that can remove some of the emotional decision-making from investing, as it eliminates the need to time the market. Let’s explore the specific advantages this strategy brings.

- Reduces Risk: Spreads investments over time, lessening the impact of market downturns.

- Disciplined Approach: Enforces regular investing habits, regardless of market conditions.

- Averages Cost: Lowers the average cost per share over time, boosting potential returns when the market recovers.

In summary, dollar-cost averaging is a strategic method to invest regularly, reducing risk and promoting disciplined investment habits, especially useful in volatile markets.

How Dollar-Cost Averaging Works

To effectively implement dollar-cost averaging, it’s essential to understand its mechanics. The process involves setting up a schedule and sticking to it, regardless of market conditions. This section details how to implement DCA and what to expect.

Setting Up Your DCA Strategy

First, determine the total amount you want to invest and the period over which you want to invest it. For example, if you have $12,000 to invest over a year, you would invest $1,000 each month. Next, choose the investment asset; this could be stocks, bonds, or mutual funds.

Executing Regular Investments

Once you’ve established your plan, it’s crucial to maintain consistency. Set up automatic transfers to your investment account to ensure that you invest the predetermined amount at regular intervals. This automation helps remove the temptation to skip investments during market downturns.

Example Scenario

Consider an investor who decides to invest $500 per month in a stock. In months when the stock price is low, they acquire more shares, and in months when the price is high, they acquire fewer shares. Over time, the average cost per share may be lower than if they had invested a lump sum at the beginning.

- Consistency is Key: Stick to your schedule, regardless of market ups and downs.

- Automatic Transfers: Automate investments to ensure consistency.

- Long-Term View: DCA works best over the long term, smoothing out price volatility.

Understanding and implementing dollar-cost averaging involves setting a schedule, maintaining consistency, and automating investments to smooth out price volatility over the long term.

Benefits of Using Dollar-Cost Averaging in 2025

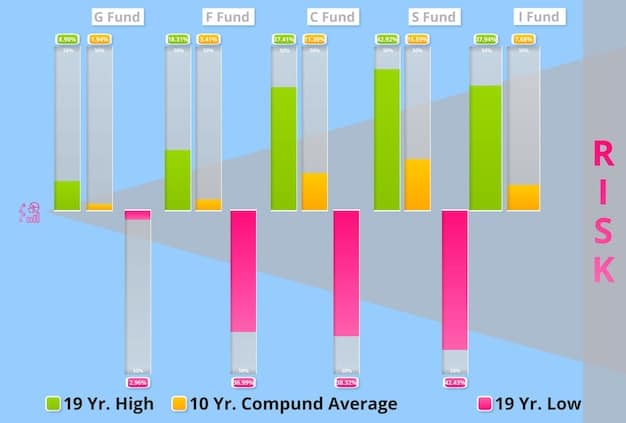

In 2025, various economic forecasts suggest a potentially volatile market environment. Utilizing dollar-cost averaging as an investment strategy can provide several key advantages, particularly reducing risk and promoting disciplined investing.

Reduced Risk in Volatile Markets

One of the primary benefits of DCA is its ability to mitigate risk. By spreading investments over time, investors are less exposed to the risk of a single, poorly timed investment. This is particularly important in a market where sudden downturns are possible.

Emotional Discipline

Market volatility can trigger emotional reactions that lead to poor investment decisions. DCA removes the need to time the market, which can help investors avoid buying high out of exuberance or selling low out of fear. This disciplined approach supports more rational long-term decision-making.

Potential for Better Returns

While DCA does not guarantee profits, it can potentially lead to better returns over time. By purchasing more shares when prices are low, investors can benefit from subsequent market recoveries. This strategy is especially effective in markets characterized by significant price oscillations.

- Market Timing Avoidance: Eliminates the guesswork and stress of timing the market.

- Volatility Mitigation: Reduces the impact of market swings on overall investment performance.

- Emotional Stability: Encourages steady investing habits, regardless of market sentiment.

Dollar-cost averaging offers reduced risk, emotional discipline, and the potential for better returns, making it a strategic approach in 2025 when market volatility is a concern.

Potential Drawbacks of Dollar-Cost Averaging

While dollar-cost averaging offers numerous benefits, it’s essential for investors to be aware of its potential drawbacks. Understanding these cons helps in making an informed decision about whether DCA aligns with their investment goals.

Opportunity Cost

One of the main criticisms of DCA is that it can lead to opportunity costs. If the market trends upward over the investment period, the investor may miss out on potential gains by not investing the entire sum upfront. Instead, they are gradually investing as prices rise.

Slower Returns in Bull Markets

In a consistently rising market, a lump-sum investment will typically outperform DCA. This is because the lump-sum investment benefits fully from the market’s upward trajectory from the start. DCA’s gradual approach means that part of the investment lags, reducing overall gains.

Transaction Costs

DCA involves multiple transactions over time, which can incur transaction costs such as brokerage fees. These costs can eat into the potential returns, especially for small investment amounts. Investors should consider these fees when evaluating the cost-effectiveness of DCA.

- Missed Gains: Gradual investment can mean missing out on early growth in a rising market.

- Transaction Fees: Regular investments can lead to higher cumulative costs.

- Not Ideal for All: May not be the best strategy in a consistently bullish market.

Understanding the drawbacks of dollar-cost averaging, such as opportunity costs, slower returns in bull markets, and transaction fees, is crucial for determining if this strategy suits your investment approach.

Is Dollar-Cost Averaging Right for You in 2025?

Deciding whether dollar-cost averaging is the right investment strategy depends on individual circumstances, risk tolerance, and market expectations. Consider these factors to assess if DCA aligns with your investment needs in 2025.

Assessing Your Risk Tolerance

If you are risk-averse and concerned about potential market downturns, DCA may be a suitable strategy. Its gradual approach reduces the impact of short-term volatility, which can provide peace of mind. However, if you are comfortable with higher risk and believe the market will generally rise, a lump-sum investment might be more appropriate.

Evaluating Your Investment Goals

Consider your investment goals. If you are saving for a long-term goal, such as retirement, DCA can be a consistent and disciplined way to build your portfolio. However, if you are seeking rapid growth over a shorter period, other strategies may be more effective.

Considering Market Conditions

Assess the anticipated market conditions for 2025, as mentioned previously. If volatility is expected, DCA’s risk-reducing properties can be valuable. But, if analysts predict a strong and steady market uptrend, a lump-sum investment might yield higher returns.

- Risk Profile: DCA suits risk-averse investors seeking stability.

- Investment Timeline: Ideal for long-term goals with regular contributions.

- Market Outlook: Best suited for volatile or uncertain market conditions.

To decide if dollar-cost averaging is right for you in 2025, consider your risk tolerance, investment goals, and the expected market conditions to ensure the strategy aligns with your needs.

Practical Tips for Implementing DCA Effectively

To maximize the benefits of dollar-cost averaging, follow these practical tips for effective implementation. These suggestions can help you refine your strategy and achieve better investment outcomes.

Automate Your Investments

Setting up automated transfers to your investment account is crucial. This ensures that you consistently invest the predetermined amount at regular intervals, without the need for manual intervention. Automation helps maintain discipline and prevents emotional decisions based on market fluctuations.

Choose the Right Investments

Select investments that align with your risk tolerance and investment goals. Diversifying your portfolio across different asset classes can further reduce risk. Consider investing in a mix of stocks, bonds, and mutual funds to create a balanced and resilient portfolio.

Stay Consistent and Patient

The key to successful dollar-cost averaging is consistency and patience. Stick to your investment schedule, regardless of market conditions. Avoid the temptation to deviate from your plan based on short-term market movements. DCA is a long-term strategy that pays off over time.

- Consistent Investment Schedule: Regular, fixed-amount contributions are essential.

- Diversified Portfolio: Spreads risk across multiple asset classes.

- Long-Term Perspective: Focus on long-term growth, ignoring short-term volatility.

Implementing dollar-cost averaging effectively involves automating investments, choosing suitable assets, and staying consistent and patient to achieve long-term growth.

| Key Point | Brief Description |

|---|---|

| 🛡️ Reduces Risk | Mitigates the impact of market fluctuations by spreading investments. |

| ⏱️ Disciplined Approach | Enforces regular investing, avoiding emotional decisions. |

| 💰 Averages Cost | Lowers average cost per share, boosting potential returns. |

| 📈 Long-Term View | Best results come from consistent investing over the long haul. |

Frequently Asked Questions

▼

The primary goal is to reduce the risk of investing a lump sum at a market peak by averaging the purchase price over time.

▼

The frequency depends on your preferences, but monthly or quarterly investments are common, providing regular market exposure.

▼

No, DCA does not guarantee profits, but aims to lower risk and promote investment discipline in varying market conditions.

▼

DCA is versatile and can be applied to stocks, bonds, mutual funds, and other assets, providing diversified investment opportunities.

▼

Continue investing as planned. Lower prices mean you buy more shares, which can boost returns when the market recovers.

Conclusion

In conclusion, dollar-cost averaging presents a strategic approach to investing, characterized by its ability to mitigate risk in volatile markets, promote disciplined investment habits, and potentially enhance long-term returns. By consistently investing a fixed amount over time, investors can navigate market fluctuations with greater stability and peace of mind. Whether DCA is the right choice for you depends on your individual circumstances, risk tolerance, and investment goals. As you consider your options for 2025, remember to carefully evaluate your financial needs and market expectations to make informed investment decisions.